Rising Star or a Dog With Fleas?

“The single biggest mistake businesses make is attempting to grow without a simple strategy to guide their daily decisions. Absent a simple strategic plan you are constantly stepping over dollars to pick up dimes — a leading cause of small business failure.”

“Sure, you probably use Quick Books or some other accounting software. They are good at telling you what HAPPENED. But to turn your business into a gold mine takes a unified strategy, skill and street smarts… to know what to MAKE HAPPEN.”

“Smart business is having a constantly-evolving strategy to WIN… not just to hope and work hard… but to actually PLAN to WIN… then PLAY to WIN. This is what gives you the EDGE over your competitors.”

“We help you do this in HOURS, not YEARS in the trial and error university of hard knocks.”~ E. R. Haas, CEO

|

The 4 Corners of a Simple Business Strategy…

When we wrote Planning to WIN The Golden Game of Business, we offered some highly educated advice that all successful businesses must recognize.

This is the exact same advice Apple, Amazon, HP, eBay, Microsoft, Paul Mitchell, Nike, and every other company that went from garage to billions actually PAID MILLIONS to learn.

I’ll let you in on this secret free!

While this is fully explained in the Golden Game System, I am giving you a head start to creating your own personal Midas Touch.

Years ago, General Electric hired the Boston Consulting Group (BCG) to figure out how it could maximize its overall profitability in each of its hundreds of different business units — from light bulbs… to generators… to nuclear power plants… to plastics… to train engines… to major appliances… to medical devices… to goods and services that spanned 23 of the then 27 SIC codes.

Put simply, GE wanted an answer to the exact same problem you face: What do we do now?

You have a business with growth potential… but, should you grow it?

How would you know?

Or, the flip side to this question, should you ever invest in a business that you are unwilling or incapable of growing?

Maybe yes, maybe no.

Should you invest hard dollars and other resources in a business that is profitable, but stagnant? Great question. How would YOU answer it? These are really BIG questions, aren’t they? As we said a week ago, the answer to rapid growth issues have BOTH a quantitative as well as qualitative aspect to consider.

If growth is on your mind, look at your Master List. How many Do It’s have made it onto your Strategic Plan from Functions 1, 2, 3, 9 and 10 (Mission, Innovation, Talent, Financial and Business Cycle Management?) High growth requires you to be an EXPERT at these Key Functions.

The following is settled thought as found online in various Wikki’s, university courses, etc. Thus, we attribute these ideas to, and thank the writers for their generous contribution to the discussion.

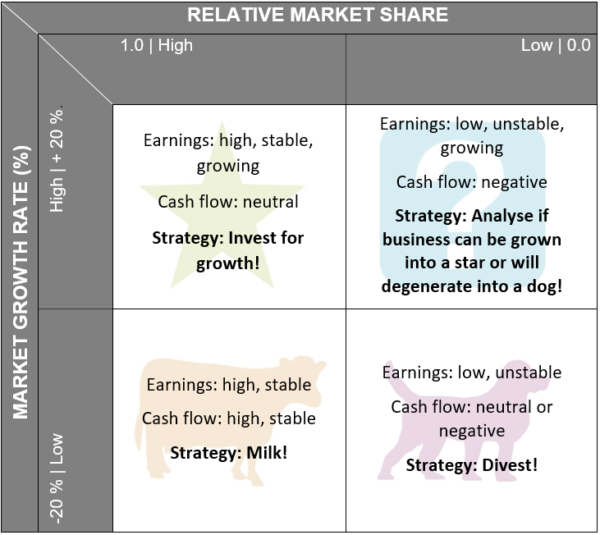

1-Stars are units with a high market share in a fast-growing industry. The hope is that stars become the next cash cows. Sustaining the business unit’s market leadership may require extra cash, but this is worthwhile if that’s what it takes for the unit to remain a leader. When growth slows, stars become cash cows if they have been able to maintain their category leadership, or they move from brief stardom to dogdom.

2-Question marks (also known as problem child) are growing rapidly and thus consume large amounts of cash, but because they have low market shares they do not generate much cash. The result is a large net cash consumption. A question mark has the potential to gain market share and become a star, and eventually a cash cow when the market growth slows. If the question mark does not succeed in becoming the market leader, then after perhaps years of cash consumption it will degenerate into a dog when the market growth declines. Question marks must be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

3-Cash cows are units with high market share in a slow-growing industry. These units typically generate cash “mature” market, and every corporation would be thrilled to own as many as possible. They are to bein excess of the amount of cash needed to maintain the business. They are regarded as staid and boring, in a “mature” market, and every corporation would be thrilled to own as many as possible. They are to be “milked” continuously with as little investment as possible, since such investment would be wasted in an industry with low growth.

4-Dogs, it is thought, should be sold off. Dogs, or more charitably called pets, are units with low market share in a mature, slow-growing industry. These units typically “break even,” generating barely enough cash to maintain the business. Though owning a break-even unit provides the social benefit of providing jobs and possible synergies that assist other business units, from an accounting point of view such a unit is worthless, not generating cash for the company. They depress a profitable company’s return on assets ratio, used by many investors to judge how well a company is being managed.

As a particular industry matures and its growth slows, all business units become either cash cows or dogs.

As a particular industry matures and its growth slows, all business units become either cash cows or dogs.

The natural cycle for most business units is that they start as question marks, then turn into stars. Eventually, the market stops growing thus the business unit becomes a cash cow.

At the end of the cycle the cash cow turns into a dog.

The overall goal of this ranking was to help corporate analysts decide which of their business units to fund, and how much; and which units to sell. Managers were supposed to gain perspective from this analysis that allowed them to plan with confidence to use money generated by the cash cows to fund the stars and, possibly, the question marks.

As the BCG stated in 1970: Only a diversified company with a balanced portfolio can use its strengths to truly capitalize on its growth opportunities.

Knowing this…

The question becomes, are you ready for growth? If so, what kind? Organic growth, just taking your single location as far as it will go? Expanding to other locations in your market area? Expanding to other regions or even globally? Expanding to other business units? Expanding your internet presence so you can remain local, but sell on a global basis? Expanding product offerings. The choices are endless.

A Simple Strategy…

Once you determine what you are going to make happen you can move forward toward the goal. Until then, you become overwhelmed, locked on the horns of a dilemma.

A simple strategy, executed well is the key to growing the next Apple, Whole Foods, Nike… even the next hot new restaurant, cycle shop, or salon.

We make strategy push-button simple.

You answer a few deeply engaging questions, tell us what your objectives are, and we give you the answer to the question, “What should we do next?”

Your Choice: Hours vs. Years…

MyBizIQ is like gaining the operational savvy of a Harvard MBA in 6 hours… not 6 years and $500,000!

Your Stress Test takes about an hour. Simple questions but profoundly predictive.

The personalized results will take you 2-3 hours to fully absorb. We have distilled the complexity of business success into a simple to understand, gaited package that guides your thinking at every step.

Then, each week you return to your secure, personal strategy page and review your actions, decisions, and your next focus.

The result is that you know exactly what you must do NEXT.

It means thinking WIN WIN…

What’s Important Now?

What’s Important Next?

The Key Word For This Decade: Volatility…

Just look at the crosscurrents of a constantly changing business landscape: China trade issues… NAFTA… ruthless competition… lack of quality and quantity of new hires… tough new business regulations… the list is endless.

Let’s take a quick walk around the Biz IQ Success Clock.

And what you can do to tame this volatility and chaos is equally endless:

And what you can do to tame this volatility and chaos is equally endless:

√ Faster new product development and innovation…

√ Smarter marketing…

√ More effective customer creation and retention…

√ Better financial controls…

√ Better operations management…

√ Better admin management…

√ More responsive actions to local business conditions.

Yes, you have thousands of choices — some good — some bad — some just ineffective — so you must choose wisely! Which is what strategy is all about.

To join the ranks of long-term successes like Apple, Amazon, Dell, Whole Foods, and a million small business who play the game of business to WIN, you must reenergize, reorganize, and reinvent your business — continuously.

It means thinking strategically and acting tactically.

√ Chaos will reign this year — get used to it…

√ Volatility is the new norm — complaining about it is counterproductive…

√ Business conditions will be good and bad… sometimes in the same month…

It is up to you to navigate these conditions and WIN. Proof?

This Gallery depicts businesses that all started with no more than an idea, little cash, but still turned into a Goldmine… after facing more than their fair share of heartbreaks and tough times.

There will be more Millionaires and Billionaires created

this year than at any time in history.

Why not you?

Check out our Midas touch Bundle.

This is a lot like gaining a Harvard MBA for only $97 Bucks!

Category: Business Growth, Featured